Examining Community Needs for Reciprocal Parametric Insurance

Investigating how parametric insurance can provide much needed financial support in high risk U.S. regions.

Overview

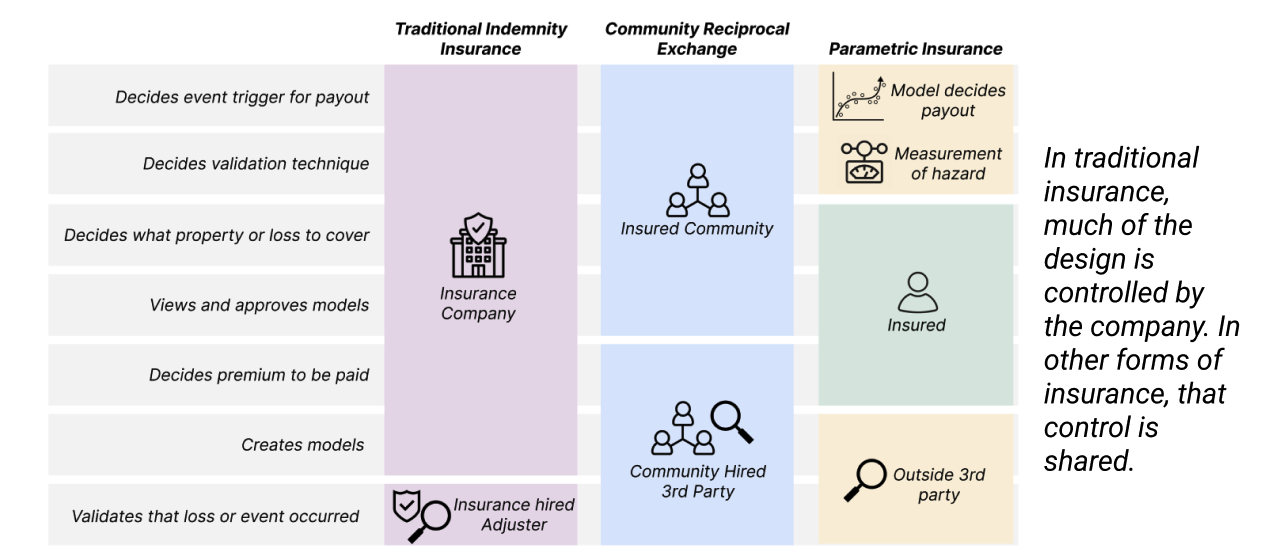

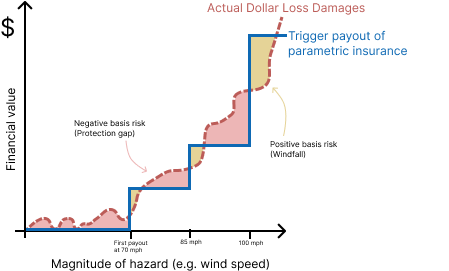

In an era of increasing climate volatility, traditional indemnity insurance is failing to keep pace. High-risk communities face a widening 'Protection Gap,' leaving residents without the rapid funds needed to recover. My research investigates Parametric Insurance as a 'first-responder' financial tool. While technically efficient, these products suffer from a critical adoption barrier: a lack of trust and user understanding. I am bridging this gap by applying Participatory Design to engineering, creating a Socio-Technical Framework that aligns actuarial solvency with community needs.

Research Questions

- How can parametric insurance be designed to meet the specific needs of high-risk communities?

- What are the key barriers to adoption of parametric insurance in residential contexts?

- How can we visualize predictive models in ways that build trust and understanding?

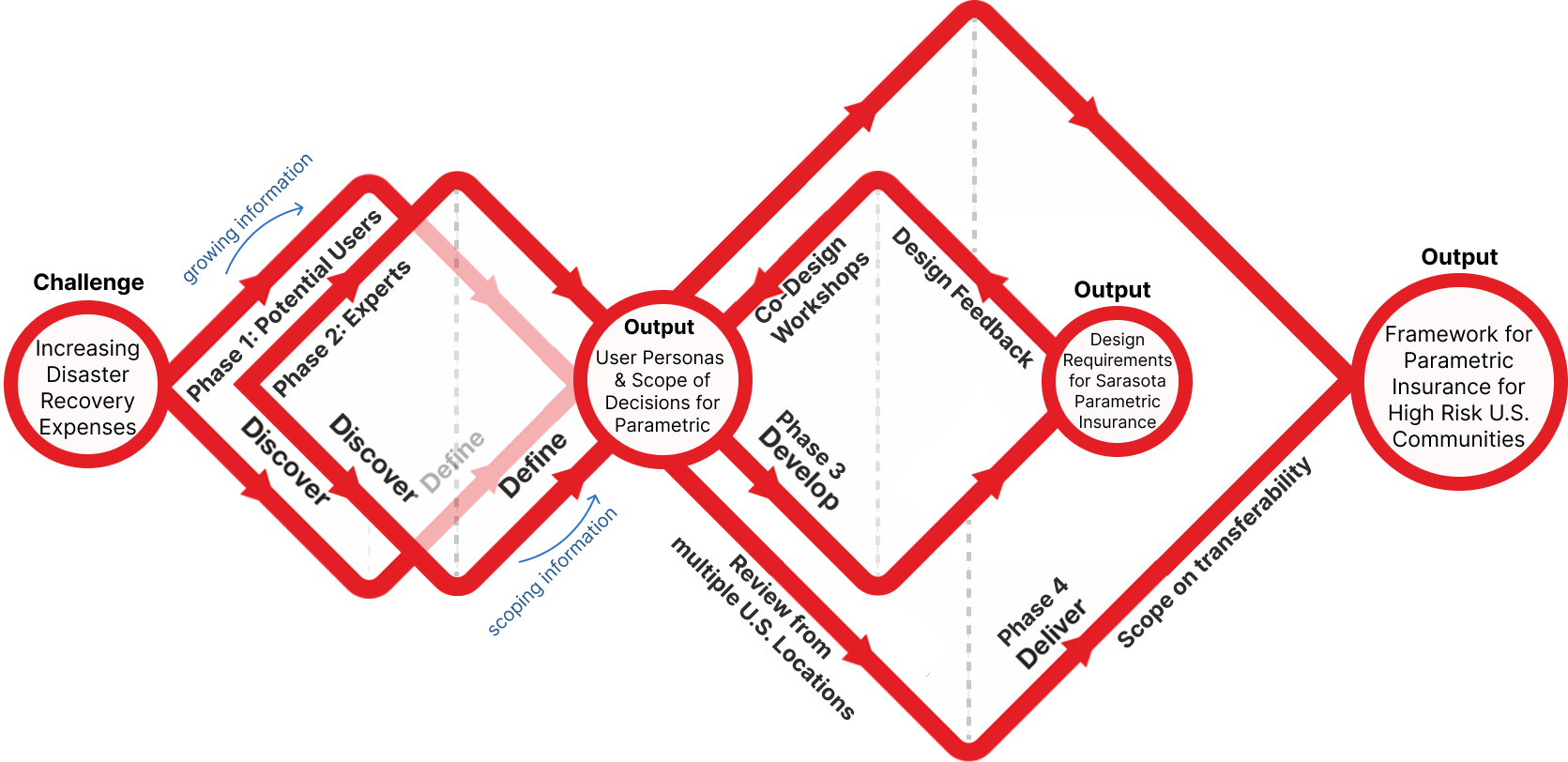

Methodology

This project employs participatory design methods to engage directly with community members in understanding their insurance needs and preferences. We combine qualitative interviews, co-design workshops, and prototype testing to develop insurance models that truly serve community needs.

Current Status

This research is ongoing. We are currently conducting community engagement sessions and developing visualization prototypes for parametric insurance concepts.